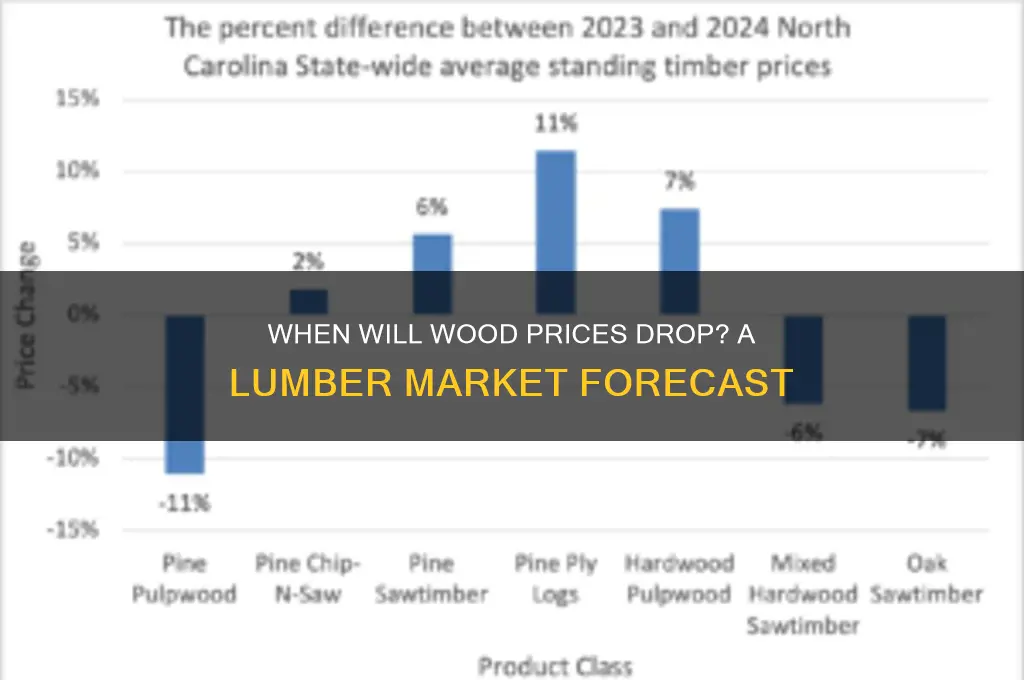

The question of when wood prices will decrease has become a pressing concern for homeowners, builders, and the construction industry alike, as the cost of lumber has seen unprecedented spikes in recent years. Driven by factors such as supply chain disruptions, increased demand for home renovations, and fluctuating tariffs, the market has experienced significant volatility. While some experts predict a gradual decline as supply catches up with demand and global logistics improve, others caution that ongoing economic uncertainties and environmental policies may continue to influence pricing. As a result, many are closely monitoring market trends and seeking insights into when relief might come, hoping for a return to more stable and affordable wood prices.

Explore related products

What You'll Learn

Supply chain disruptions impact

The COVID-19 pandemic exposed the fragility of global supply chains, and the lumber industry was no exception. Mills shut down, transportation routes were disrupted, and labor shortages became the norm. These disruptions created a perfect storm, causing wood prices to skyrocket. While demand for lumber surged as people embarked on home improvement projects during lockdowns, the supply chain's inability to keep pace exacerbated the price hike. This imbalance highlights the critical role supply chain efficiency plays in determining wood prices.

A key factor in the ongoing wood price volatility is the ripple effect of supply chain disruptions. Delays in shipping, port congestion, and a shortage of truck drivers have all contributed to longer lead times and increased costs. For instance, a shipment of lumber from Canada, a major supplier to the US market, might face delays at the border due to staffing shortages, adding weeks to its journey. These delays not only inflate prices but also create uncertainty for builders and consumers alike, making it difficult to plan and budget for projects.

Consider the impact on a small construction company. They might quote a project based on current lumber prices, only to face significant cost overruns if prices surge during the construction phase. This unpredictability can lead to project delays, strained client relationships, and even financial losses. To mitigate these risks, companies are increasingly focusing on supply chain resilience. This involves diversifying suppliers, exploring alternative transportation routes, and investing in technology to improve inventory management and forecasting.

While these strategies can help, rebuilding a robust and resilient supply chain takes time. The lumber industry is still grappling with the aftermath of the pandemic, and the effects of these disruptions will likely be felt for months, if not years, to come.

Therefore, a significant decline in wood prices hinges on the restoration of a stable and efficient supply chain. This requires addressing labor shortages, streamlining transportation networks, and fostering collaboration across the entire supply chain. Until these issues are resolved, wood prices are likely to remain volatile, impacting both the construction industry and consumers.

Railroad Ties vs. Treated Wood: Which Lasts Longer in Landscaping?

You may want to see also

Explore related products

Lumber demand trends analysis

Lumber demand has been on a rollercoaster ride over the past few years, driven by fluctuating housing markets, supply chain disruptions, and shifting consumer behaviors. During the pandemic, a surge in DIY projects and new home construction sent prices soaring to record highs. However, recent data suggests a cooling trend, with demand softening as interest rates rise and economic uncertainty grows. To understand when wood prices might stabilize or decline, it’s critical to analyze these demand trends and their underlying drivers.

One key factor influencing lumber demand is the housing market, which accounts for roughly 70% of lumber consumption. New home starts and renovation projects are strong indicators of future demand. For instance, in 2021, U.S. housing starts reached a 15-year high, fueling unprecedented lumber demand. However, as mortgage rates climbed in 2022 and 2023, new construction slowed, reducing the need for lumber. Builders and investors should monitor housing market forecasts closely, as a sustained decline in starts could signal lower lumber demand and, eventually, price reductions.

Another trend shaping lumber demand is the rise of sustainable building practices and alternative materials. Increasingly, architects and developers are turning to steel, concrete, and engineered wood products as eco-friendly or cost-effective substitutes. For example, cross-laminated timber (CLT) is gaining popularity in commercial construction due to its strength and reduced carbon footprint. While traditional lumber remains dominant, the growing adoption of alternatives could temper demand and contribute to price stabilization over the next 3–5 years.

Global trade dynamics also play a significant role in lumber demand trends. Canada, the largest exporter of softwood lumber to the U.S., faced tariffs and supply constraints in recent years, exacerbating price volatility. However, ongoing negotiations and improved supply chains could ease these pressures, making lumber more affordable. Additionally, emerging markets like China and India are increasing their lumber imports for infrastructure projects, though their impact on global prices remains moderate. Tracking these international shifts can provide insights into future price movements.

For homeowners and contractors, understanding these trends can inform strategic purchasing decisions. If demand continues to soften due to economic headwinds and alternative materials gain traction, prices could begin to decline by late 2024 or early 2025. In the meantime, bulk buying during seasonal dips (e.g., winter months when construction slows) or exploring substitute materials can mitigate costs. Staying informed and adaptable is key in navigating the evolving lumber market.

Drying Cedar Wood: Optimal Time and Techniques for Perfect Results

You may want to see also

Explore related products

Economic recovery effects

The lumber market's volatility has been a rollercoaster, with prices soaring to unprecedented heights during the pandemic-induced construction boom and subsequent supply chain disruptions. As economies rebound, the question on everyone's mind is: when will wood prices return to pre-pandemic levels? Economic recovery plays a pivotal role in this narrative, but its impact is complex and multifaceted.

The Supply-Demand Imbalance: During economic upswings, construction activity surges, driving up demand for lumber. However, the supply side struggles to keep pace. Sawmills, facing labor shortages and logistical challenges, cannot increase production overnight. This imbalance creates a perfect storm, pushing prices higher. For instance, the US housing market's rapid recovery in 2021 led to a 400% spike in lumber prices, causing builders to delay projects and homeowners to rethink renovations.

A Comparative Perspective: Consider the post-2008 recession era. It took approximately 18 months for wood prices to stabilize after the initial economic rebound. This time, however, the recovery is more robust, and the supply chain issues are more intricate. Experts predict a longer adjustment period, estimating that prices may not normalize until late 2024 or early 2025. This extended timeline is a cautionary tale for builders and consumers alike, urging them to plan projects with flexibility and consider alternative materials.

Strategies for Mitigation: To navigate this challenging period, industry players must adopt adaptive strategies. Builders can explore modular construction techniques, reducing on-site labor and material demands. Homeowners might consider phased renovations, spreading costs over time. Additionally, investing in sustainable forestry practices and technology can enhance long-term supply resilience. Governments can play a role by offering incentives for sawmill modernization and workforce development, ensuring the industry's ability to respond to future demand fluctuations.

The Silver Lining: While high wood prices pose challenges, they also stimulate innovation. The current crisis has accelerated the adoption of mass timber construction, a sustainable and efficient building method. This shift could revolutionize the industry, reducing waste and increasing productivity. As the market adjusts, these innovations will likely persist, shaping a more resilient and environmentally conscious lumber sector. Thus, the economic recovery's impact on wood prices is not merely a return to the past but a catalyst for transformative change.

Bleaching Wood: Optimal Time to Leave Bleach for Best Results

You may want to see also

Explore related products

Global market influences

Global supply chains, particularly those originating from major timber-exporting countries like Canada, Russia, and Brazil, play a pivotal role in determining wood prices. Disruptions in these chains—whether due to geopolitical tensions, trade restrictions, or logistical bottlenecks—can cause prices to spike. For instance, the 2021 surge in lumber prices was partly fueled by supply chain delays exacerbated by the COVID-19 pandemic. Monitoring these disruptions and their resolution timelines is essential for predicting when prices might stabilize. If you’re tracking wood prices, focus on updates from key exporting nations and their trade policies, as these directly impact availability and cost.

Currency fluctuations add another layer of complexity to global wood markets. The strength of the U.S. dollar, for example, can make imports cheaper or more expensive, influencing domestic prices. When the dollar weakens, imported wood becomes costlier, driving up prices for consumers. Conversely, a strong dollar can lower import costs, potentially easing price pressures. To hedge against this volatility, businesses and consumers alike should consider long-term contracts or currency-hedging strategies. Keep an eye on forex trends, especially if you’re involved in international trade, as these shifts can signal upcoming price movements.

Environmental policies and sustainability initiatives are reshaping the global timber market. Countries with stricter forestry regulations, such as those in the European Union, often face higher production costs, which are passed on to consumers. Meanwhile, regions with lax regulations may offer cheaper wood but risk long-term supply instability due to deforestation. For those seeking price relief, watch for shifts in global sustainability standards and their adoption rates. Increased certification of sustainable timber could stabilize prices by ensuring consistent supply, but this transition takes time—likely years, not months.

Finally, global demand dynamics, particularly from emerging economies like China and India, are a critical factor. Rapid urbanization and infrastructure development in these nations drive up wood consumption, putting upward pressure on prices. However, economic slowdowns or policy shifts in these markets can lead to reduced demand and potential price declines. If you’re waiting for prices to drop, track economic indicators in these countries, such as construction activity and GDP growth. A slowdown in their demand could be the catalyst for global wood prices to ease.

Mastering Driftwood: Time, Techniques, and Tips for Perfect Results

You may want to see also

Explore related products

Seasonal price fluctuations patterns

Wood prices, like many commodities, exhibit distinct seasonal fluctuations that savvy buyers and sellers can leverage. Spring and early summer often see a surge in demand as construction and home improvement projects ramp up, driving prices higher. This pattern is particularly pronounced in regions with defined building seasons, such as the northern United States and Canada, where warmer months are critical for outdoor work. For instance, lumber prices historically peak in May or June, coinciding with the start of peak construction activity. Understanding this cycle allows buyers to anticipate price hikes and plan purchases accordingly, while sellers can optimize inventory and pricing strategies to maximize profits during these high-demand periods.

Conversely, fall and winter typically bring a downturn in wood prices as demand wanes. With fewer construction projects underway and outdoor activities limited by colder weather, the market becomes saturated with excess supply. This oversupply often leads to price drops, making late fall and early winter ideal times for buyers to stock up on materials. For example, in 2022, lumber prices plummeted by over 50% from their spring highs by December, reflecting the seasonal slowdown. Monitoring these trends can help consumers save significantly, while suppliers can adjust by offering discounts to clear inventory before the next demand cycle begins.

However, seasonal patterns are not the only factor at play. External variables like global supply chain disruptions, natural disasters, and economic conditions can amplify or distort these fluctuations. For instance, the 2021 lumber price spike, which saw costs triple in a matter of months, was driven by a combination of pandemic-related supply shortages and unprecedented demand for home renovations. Such anomalies highlight the importance of staying informed about broader market dynamics, even when relying on seasonal trends. Tools like market reports, futures contracts, and industry forecasts can provide additional context to refine timing decisions.

To capitalize on seasonal price fluctuations, consider adopting a strategic purchasing approach. For homeowners planning renovations, scheduling projects for late summer or early fall can take advantage of lower material costs. Contractors, on the other hand, might benefit from bulk buying during winter months to secure materials at discounted rates for upcoming spring projects. Additionally, tracking regional weather patterns and economic indicators can offer early signals of potential deviations from typical seasonal trends. By combining historical data with real-time insights, buyers and sellers alike can navigate wood price fluctuations with greater precision and confidence.

Morning Wood and Penis Size: Separating Fact from Fiction

You may want to see also

Frequently asked questions

It’s difficult to predict an exact timeline, as wood prices depend on factors like supply chain issues, demand, and economic conditions. Prices may stabilize or decrease within 6 months to 2 years, but this varies based on market trends.

High demand from construction and DIY projects, supply chain disruptions, labor shortages, and increased production costs are the primary factors keeping wood prices elevated.

It’s unlikely that wood prices will return to pre-pandemic levels in the near future. While prices may decrease, ongoing global economic pressures and increased production costs suggest they will remain higher than before 2020.