Kathy Wood, the renowned CEO and founder of ARK Invest, is a prominent figure in the investment world, known for her forward-thinking approach and focus on disruptive innovation. Her investment decisions are closely watched by market participants, as they often signal emerging trends in technology, healthcare, and other high-growth sectors. Recently, there has been significant interest in what Kathy Wood is buying, as her portfolio moves can provide valuable insights into where she sees the most potential for future growth. By analyzing her purchases, investors can gain a deeper understanding of the innovative companies and technologies that are poised to shape the global economy in the years to come.

Explore related products

What You'll Learn

- ARK Invest’s Latest Buys: Recent purchases by Kathy Wood’s ARK Invest funds

- Top Holdings in ARKK: Key stocks in ARK Innovation ETF (ARKK)

- Wood’s Tech Picks: Kathy Wood’s investments in disruptive technology companies

- Healthcare Stocks in Focus: ARK’s bets on biotech and healthcare innovations

- Wood’s Bitcoin Strategy: ARK’s exposure to Bitcoin and blockchain technologies

ARK Invest’s Latest Buys: Recent purchases by Kathy Wood’s ARK Invest funds

Cathie Wood, the visionary founder of ARK Invest, is known for her bold bets on disruptive innovation. Her recent purchases across ARK’s actively managed ETFs reveal a continued focus on transformative technologies, even amid market volatility. Let’s dissect ARK’s latest buys, uncovering the trends and potential opportunities they signal.

Recent additions to ARK’s portfolios highlight a renewed interest in genomics and healthcare innovation. In February 2024, ARK significantly increased its stake in Pacific Biosciences (PACB), a leader in long-read DNA sequencing technology. This move aligns with Wood’s long-standing thesis on the convergence of AI and genomics, where advanced sequencing could accelerate drug discovery and personalized medicine. Investors should note that PACB’s technology, while promising, is still in the growth phase, making it a high-risk, high-reward play.

ARK’s foray into the fintech space continues with strategic buys in companies like Block (SQ) and Coinbase (COIN). Despite regulatory headwinds in the cryptocurrency sector, Wood remains bullish on blockchain’s potential to revolutionize financial systems. Block’s Cash App and Coinbase’s exchange platform are seen as gateways to broader adoption of digital assets. However, investors should approach these holdings with caution, as regulatory uncertainty and market sentiment can cause significant price swings.

The firm’s commitment to artificial intelligence remains unwavering, with recent purchases in UIPath (PATH) and C3.ai (AI). Both companies leverage AI to automate business processes, a trend Wood believes will drive productivity gains across industries. UIPath’s robotic process automation (RPA) and C3.ai’s enterprise AI solutions are positioned to benefit from the growing demand for efficiency in corporate operations. While these stocks have experienced volatility, ARK’s buys suggest confidence in their long-term growth potential.

ARK’s latest buys also reflect a contrarian approach, with increased positions in Tesla (TSLA) amid its recent stock decline. Wood’s conviction in Tesla’s leadership in autonomous driving and energy storage remains unshaken, despite near-term challenges like production slowdowns and competitive pressures. This move underscores ARK’s strategy of buying dips in companies it believes are fundamentally undervalued. Investors should consider their risk tolerance, as Tesla’s trajectory remains tied to macroeconomic factors and technological milestones.

Practical takeaway: ARK’s recent buys offer a roadmap for investors seeking exposure to disruptive technologies. However, these holdings are not for the faint-hearted. Wood’s strategy involves high-conviction, long-term bets on innovation, which can lead to significant volatility. Investors should diversify their portfolios and align their investments with their risk appetite and time horizon. Monitoring ARK’s filings for real-time insights can provide valuable clues into emerging trends, but independent research is essential to make informed decisions.

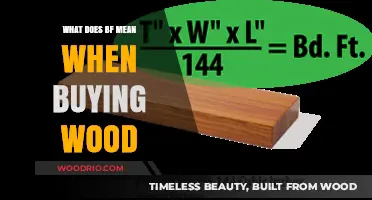

Top Sources for Buying Wood Beams to Enhance Your Ceiling Design

You may want to see also

Explore related products

Top Holdings in ARKK: Key stocks in ARK Innovation ETF (ARKK)

Cathie Wood, the visionary behind ARK Invest, is renowned for her bold bets on disruptive innovation. Her flagship fund, the ARK Innovation ETF (ARKK), offers a window into her investment philosophy, focusing on companies poised to revolutionize industries. Let's dissect the top holdings in ARKK, understanding why Wood believes these companies are the future.

Tesla (TSLA): The Electric Vehicle Juggernaut

Unsurprisingly, Tesla dominates ARKK's portfolio. Wood's conviction in Tesla extends beyond its current position as an EV leader. She sees Tesla as a multifaceted disruptor, with its autonomous driving technology, energy storage solutions, and potential for robotaxis painting a picture of a company reshaping transportation and energy infrastructure. Critics argue Tesla's valuation is inflated, but Wood's long-term outlook prioritizes growth potential over short-term price fluctuations.

Roku (ROKU): Streaming's Gateway

Roku's presence in ARKK highlights Wood's belief in the continued growth of streaming services. As a leading streaming platform aggregator, Roku benefits from the cord-cutting trend and the fragmentation of the media landscape. Wood sees Roku as more than just a hardware provider; its data-driven advertising platform positions it to capture a significant share of the burgeoning streaming ad market.

Teladoc Health (TDOC): Telemedicine's Rise

Teladoc's inclusion reflects Wood's confidence in the long-term shift towards telemedicine. The pandemic accelerated this trend, but Wood believes it's here to stay. Teladoc's platform connects patients with healthcare providers remotely, improving access and convenience. While facing competition, Teladoc's established position and focus on chronic care management give it an edge in this rapidly growing market.

Unity Software (U): Powering the Metaverse

Unity's presence in ARKK underscores Wood's enthusiasm for the metaverse. As a leading game engine developer, Unity provides the tools for creating immersive 3D experiences, crucial for the metaverse's development. Beyond gaming, Wood sees Unity's technology being applied in architecture, film, and even industrial design, making it a key player in the metaverse's evolution.

Takeaway: A Bet on the Future, Not Without Risk

ARKK's top holdings represent a concentrated bet on disruptive technologies with immense growth potential. However, these investments are inherently risky. High valuations, regulatory hurdles, and technological challenges could derail their progress. Wood's strategy demands a long-term perspective and a tolerance for volatility. Investors should carefully consider their risk appetite before diving into ARKK, understanding that the path to innovation is rarely smooth.

Where to Find High-Quality Wood Blocks for Your Next Project

You may want to see also

Explore related products

$25.88 $27.62

Wood’s Tech Picks: Kathy Wood’s investments in disruptive technology companies

Kathy Wood, the visionary founder of ARK Invest, is renowned for her bold bets on disruptive innovation. Her tech picks aren’t just investments; they’re strategic wagers on companies poised to redefine industries. By focusing on genomics, artificial intelligence, robotics, energy storage, and blockchain technology, Wood targets firms at the intersection of exponential growth and transformative potential. Her approach isn’t about playing it safe—it’s about identifying the next Tesla, CRISPR, or Bitcoin before the mainstream catches on.

Consider her portfolio’s emphasis on genomics. ARK Invest has consistently backed companies like CRISPR Therapeutics and Pacific Biosciences, which are pioneering gene-editing technologies. These aren’t incremental advancements; they’re tools that could cure genetic diseases, extend lifespans, and revolutionize personalized medicine. Wood’s conviction in this space is rooted in her belief that the cost of gene sequencing will plummet, making these technologies accessible to billions. For investors, this means exposure to a sector with a potential market size in the trillions.

Artificial intelligence is another cornerstone of Wood’s strategy. She’s not just buying AI stocks; she’s investing in the infrastructure that powers it. Companies like UiPath, which automates repetitive tasks, and Tesla, which leverages AI for autonomous driving, are prime examples. Wood’s thesis is that AI will permeate every industry, from healthcare to logistics, creating unprecedented efficiency gains. Her funds, such as the ARK Autonomous Technology & Robotics ETF (ARKQ), offer a diversified way to capitalize on this trend without picking individual winners.

What sets Wood apart is her willingness to endure volatility for long-term gains. Her portfolios often include high-risk, high-reward stocks that can swing wildly in the short term. Take her investments in electric vehicle (EV) and battery technology companies like Tesla and QuantumScape. While critics argue these stocks are overvalued, Wood sees them as undervalued relative to their potential to dominate the future of transportation and energy storage. Her advice to investors is clear: stay focused on the five-year horizon, not the five-minute news cycle.

To replicate Wood’s strategy, start by studying her methodology. ARK Invest publishes daily trade notifications and research reports, offering transparency into her thinking. Diversify across her thematic ETFs, such as ARKK (Innovation), ARKG (Genomics), and ARKW (Fintech), to align with her disruptive tech focus. However, exercise caution: these investments are not for the faint of heart. Allocate no more than 10–15% of your portfolio to high-risk, high-growth sectors, and regularly rebalance to manage exposure. Wood’s picks are a masterclass in forward-thinking investing, but they require patience, discipline, and a tolerance for uncertainty.

Where to Find and Buy 5-Foot Wood Fence Panels Easily

You may want to see also

Explore related products

Healthcare Stocks in Focus: ARK’s bets on biotech and healthcare innovations

Cathie Wood’s ARK Invest has become synonymous with disruptive innovation, and her recent moves in healthcare stocks signal a bold bet on biotech and medical breakthroughs. Unlike traditional healthcare funds, ARK focuses on companies at the vanguard of genetic editing, personalized medicine, and digital health—areas poised to redefine patient care. For instance, ARK’s holdings in CRISPR gene-editing firms like Intellia Therapeutics (NTLA) and Beam Therapeutics (BEAM) highlight her confidence in technologies capable of curing previously untreatable genetic disorders. These aren’t speculative gambles; they’re calculated investments in platforms with the potential to deliver life-altering therapies within the next decade.

Consider the implications of ARK’s stake in companies developing mRNA technologies beyond COVID-19 vaccines. Moderna (MRNA), a cornerstone holding, is now targeting rare diseases and personalized cancer vaccines. ARK’s thesis here is twofold: mRNA’s versatility could reduce drug development timelines from years to months, and its precision could minimize side effects compared to traditional treatments. For investors, this isn’t just about buying a stock—it’s about aligning with a paradigm shift in how diseases are treated. However, patience is critical; these innovations require rigorous clinical trials and regulatory approvals, making this a long-term play.

ARK’s focus on digital health and telemedicine also stands out. Holdings like Teladoc Health (TDOC) and 10x Genomics (TXG) reflect Wood’s belief in data-driven healthcare ecosystems. Teladoc’s AI-powered platforms enable remote diagnostics and chronic disease management, while 10x Genomics’ single-cell analysis tools are revolutionizing drug discovery. These companies aren’t just responding to trends—they’re creating them. For retail investors, this presents an opportunity to capitalize on the convergence of healthcare and technology, but it also demands an understanding of the sector’s complexities. Not all digital health companies are created equal; ARK’s picks prioritize scalability and proprietary tech over mere market presence.

One cautionary note: ARK’s healthcare bets are inherently volatile. Biotech stocks often swing on clinical trial results or regulatory decisions, and ARK’s concentration in early-stage companies amplifies this risk. Take, for example, the recent dip in shares of Unity Biotechnology (UBX) after a Phase 2 trial setback. While ARK doubled down, such moves underscore the need for diversification and a strong risk appetite. Investors should view these holdings as part of a broader portfolio, not standalone bets.

In conclusion, ARK’s healthcare strategy isn’t for the faint of heart, but it offers exposure to some of the most transformative innovations of our time. By focusing on gene editing, mRNA therapies, and digital health, Wood is positioning her funds at the intersection of biology and technology. For those willing to embrace volatility and think decades ahead, these stocks could redefine what’s possible in healthcare—and in portfolio returns.

Where to Buy Wood Arrows in Bulk for Archery Enthusiasts

You may want to see also

Explore related products

Wood’s Bitcoin Strategy: ARK’s exposure to Bitcoin and blockchain technologies

Cathie Wood, the visionary founder of ARK Invest, has become synonymous with disruptive innovation, and her Bitcoin strategy is a cornerstone of this reputation. ARK's exposure to Bitcoin and blockchain technologies isn't a fleeting fad; it's a calculated bet on the future of finance.

The Core Holding: Bitcoin as Digital Gold

ARK's flagship fund, the ARK Innovation ETF (ARKK), holds a significant portion of its assets in the Grayscale Bitcoin Trust (GBTC), a publicly traded vehicle offering exposure to Bitcoin's price movements. This direct investment reflects Wood's belief in Bitcoin as a store of value, akin to digital gold, capable of hedging against inflation and currency devaluation.

Beyond Bitcoin: The Blockchain Ecosystem

ARK's strategy extends far beyond simply holding Bitcoin. They invest in companies actively building the infrastructure and applications that will power the blockchain revolution. This includes firms developing:

- Blockchain platforms: Like Coinbase (COIN), a leading cryptocurrency exchange, and Silvergate Capital (SI), a bank specializing in servicing the crypto industry.

- Blockchain-enabled solutions: Companies leveraging blockchain for supply chain management, identity verification, and decentralized finance (DeFi) applications.

A High-Risk, High-Reward Play

Investing in Bitcoin and blockchain technologies is inherently risky. The market is volatile, regulatory uncertainty looms, and many projects may fail. However, ARK's long-term outlook aligns with the potential for transformative growth. Wood believes blockchain technology will disrupt traditional financial systems, create new industries, and unlock trillions in value.

Key Takeaway: ARK's Bitcoin strategy isn't for the faint of heart. It's a high-conviction bet on a future where blockchain technology reshapes the world. Investors should carefully consider their risk tolerance and investment horizon before diving into this volatile but potentially lucrative space.

Affordable Faux Wooden Blinds: Cost Guide for Budget-Friendly Window Treatments

You may want to see also

Frequently asked questions

Kathy Wood, CEO of ARK Invest, is known for investing in innovative and disruptive technologies. Recently, she has been buying stocks in sectors like genomics, artificial intelligence, robotics, and electric vehicles, with a focus on companies like Tesla, Roku, and CRISPR-related firms.

Kathy Wood is bullish on Tesla due to its leadership in electric vehicles, autonomous driving technology, and energy storage solutions. She believes Tesla’s long-term growth potential justifies its high valuation and continues to add it to ARK’s portfolios.

Kathy Wood’s strategy revolves around identifying companies with disruptive innovation and high growth potential. She focuses on long-term trends like DNA sequencing, AI, and renewable energy, often buying during market dips or when stocks are undervalued.

Yes, Kathy Wood is a strong advocate for Bitcoin and blockchain technology. ARK Invest holds significant positions in Bitcoin via the Grayscale Bitcoin Trust (GBTC) and invests in companies like Coinbase and blockchain infrastructure providers. She believes Bitcoin will play a key role in the future of finance.