Cathie Wood, the renowned founder and CEO of ARK Invest, is a prominent figure in the investment world, known for her bold, forward-thinking approach to technology and innovation. Her firm’s actively managed ETFs, such as ARKK, ARKW, and ARKG, focus on disruptive technologies like artificial intelligence, genomics, blockchain, and robotics. Investors closely monitor her moves, as her picks often signal emerging trends and high-growth opportunities. Understanding what Cathie Wood is buying provides valuable insights into the future of innovation and potential market leaders, making her portfolio a barometer for tech-driven investments.

Explore related products

What You'll Learn

- ARK Invest’s Top Picks: Latest stocks Cathie Wood’s ARK Invest is heavily investing in

- Disruptive Innovation Focus: Sectors like AI, genomics, and fintech ARK is targeting

- Tesla and Beyond: Wood’s continued bullish stance on Tesla and other EV plays

- Biotech Bets: ARK’s investments in cutting-edge biotech and healthcare companies

- Bitcoin and Crypto: Wood’s outlook on Bitcoin and blockchain technology investments

ARK Invest’s Top Picks: Latest stocks Cathie Wood’s ARK Invest is heavily investing in

Cathie Wood’s ARK Invest has become synonymous with disruptive innovation, and her latest portfolio moves reveal a laser focus on transformative technologies. Among ARK’s top picks, Tesla (TSLA) remains a cornerstone, despite its recent volatility. Wood’s conviction in Tesla’s autonomous driving capabilities and its role in the energy transition is unwavering. ARK’s models project Tesla’s stock could reach $2,000 by 2027, driven by its robotaxi fleet and battery advancements. This isn’t just a bet on electric vehicles; it’s a wager on a future where Tesla dominates multiple industries.

Another standout is UiPath (PATH), a leader in robotic process automation (RPA). ARK’s investment thesis hinges on UiPath’s ability to streamline business operations through AI-powered software bots. With enterprises increasingly prioritizing efficiency, UiPath’s potential to capture a significant share of the $60 billion RPA market by 2025 is compelling. ARK’s confidence in UiPath’s long-term growth is evident in its consistent accumulation, even amid the stock’s post-IPO struggles.

Roku (ROKU) is a more speculative play, but ARK sees it as a key player in the streaming ecosystem. Despite intense competition from Amazon and Google, Roku’s ad-supported platform and growing international footprint position it as a beneficiary of the cord-cutting trend. ARK’s models suggest Roku could achieve $100 billion in revenue by 2030, driven by ad monetization and platform expansion. This pick reflects Wood’s belief in the convergence of media and technology.

ARK’s investment in DraftKings (DKNG) underscores its bullish outlook on the online sports betting and iGaming market. With legalization spreading across the U.S., DraftKings is poised to capitalize on a market projected to reach $35 billion by 2025. ARK’s stake in DraftKings isn’t just about gambling; it’s about the broader digital transformation of entertainment. However, investors should note the stock’s sensitivity to regulatory changes and competitive pressures.

Lastly, Teladoc Health (TDOC) represents ARK’s bet on the future of telemedicine. While the stock has faced headwinds post-pandemic, ARK views Teladoc as a long-term winner in the shift toward virtual healthcare. With chronic care management and mental health services driving growth, Teladoc’s addressable market could exceed $100 billion by 2030. This investment aligns with ARK’s broader theme of healthcare innovation, emphasizing accessibility and efficiency.

In summary, ARK’s top picks reflect a bold vision of the future, where disruptive technologies reshape industries. From autonomous vehicles to AI-driven automation, these stocks aren’t for the faint of heart. They require patience and a tolerance for volatility. But for investors aligned with Wood’s thesis, these picks offer a roadmap to potentially outsized returns in the next decade.

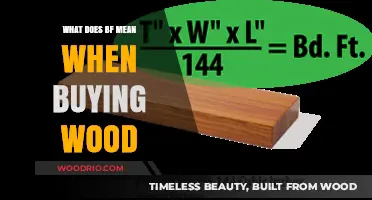

Mastering the Art of Choosing the Perfect Wood Smoker

You may want to see also

Explore related products

Disruptive Innovation Focus: Sectors like AI, genomics, and fintech ARK is targeting

Cathie Wood’s ARK Invest is synonymous with disruptive innovation, a strategy that zeroes in on transformative technologies poised to reshape industries. Among the sectors ARK targets, artificial intelligence (AI), genomics, and fintech stand out as pillars of this approach. These fields are not just evolving—they’re revolutionizing how we live, work, and interact with the world. By focusing on companies at the forefront of these sectors, ARK aims to capture exponential growth potential, even if it means embracing volatility along the way.

Consider AI, a sector ARK views as the backbone of the next industrial revolution. From autonomous vehicles to predictive analytics, AI is permeating every industry. ARK’s investments in companies like Tesla and UiPath highlight its belief in AI’s ability to drive efficiency and innovation. For instance, Tesla’s Full Self-Driving (FSD) technology isn’t just about cars—it’s a real-world AI platform generating data that could accelerate machine learning advancements. If you’re looking to align your portfolio with AI’s trajectory, focus on companies with robust data ecosystems and scalable AI applications, as these are likely to dominate the market.

Genomics is another sector ARK sees as a game-changer, with the potential to personalize medicine and extend human lifespans. Companies like CRISPR Therapeutics and Pacific Biosciences are at the forefront of gene editing and DNA sequencing, technologies that could cure previously untreatable diseases. ARK’s thesis here is clear: as genomic sequencing costs plummet (from $100 million per genome in 2001 to under $600 today), accessibility will surge, unlocking a multi-trillion-dollar market. For investors, this means identifying firms with proprietary technologies or strong intellectual property in gene editing and sequencing.

Fintech, meanwhile, is disrupting traditional banking and financial systems, offering faster, cheaper, and more inclusive solutions. ARK’s holdings in companies like Square (now Block) and Coinbase underscore its confidence in digital payments and cryptocurrencies. The rise of decentralized finance (DeFi) and blockchain technology is particularly noteworthy, as it challenges legacy financial infrastructure. If you’re exploring fintech investments, prioritize companies leveraging blockchain for scalability and security, as these will likely lead the next wave of financial innovation.

ARK’s approach to these sectors isn’t without risk. Disruptive innovation often faces regulatory hurdles, market skepticism, and technological challenges. However, the potential rewards are immense for those willing to look beyond short-term fluctuations. Practical tip: diversify within these sectors to mitigate risk while maintaining exposure to high-growth opportunities. For example, pair AI hardware investments with AI software plays, or balance genomics stocks with fintech ETFs to create a resilient portfolio aligned with ARK’s vision. By focusing on these transformative sectors, investors can position themselves at the vanguard of the innovation economy.

Choosing the Perfect Pooja Meditation Wooden Stool: A Buyer's Guide

You may want to see also

Explore related products

Tesla and Beyond: Wood’s continued bullish stance on Tesla and other EV plays

Cathie Wood, the founder and CEO of ARK Invest, remains steadfast in her bullish outlook on Tesla, despite the stock’s volatility and broader market skepticism. Her conviction stems from Tesla’s unparalleled innovation in electric vehicles (EVs), autonomous driving, and energy storage. Wood’s ARK funds have consistently increased their Tesla holdings, viewing the company not just as a carmaker but as a technology disruptor poised to dominate multiple industries. Tesla’s gigafactories, battery advancements, and AI capabilities are central to her thesis, with ARK predicting the stock could reach $2,000 per share by 2027. This bold forecast is underpinned by Tesla’s potential to achieve a 15% market share in global auto sales and leadership in robotaxi services.

Beyond Tesla, Wood is betting on a broader EV ecosystem that includes suppliers, battery innovators, and autonomous driving enablers. Companies like Li Auto, Xpeng, and Nio are part of her portfolio, reflecting her belief in China’s growing EV market. She also highlights the importance of materials like lithium and nickel, investing in firms like Albemarle and MP Materials to capitalize on the supply chain. ARK’s research suggests that EV sales could surpass 40% of global auto sales by 2025, driven by falling battery costs and government incentives. This shift, Wood argues, will create trillion-dollar opportunities for companies at the forefront of electrification and automation.

For investors, Wood’s approach offers a roadmap but comes with risks. Her high-conviction, innovation-focused strategy has delivered outsized returns but also significant volatility. To emulate her EV plays, diversify across subsectors—batteries, semiconductors, and software—rather than concentrating solely on automakers. Monitor regulatory changes and technological breakthroughs, as these can accelerate or derail growth. Start with a small allocation (5–10% of your portfolio) to innovation-focused ETFs like ARK’s, gradually increasing exposure as trends solidify.

A comparative analysis reveals Wood’s edge: while traditional auto analysts focus on quarterly earnings, she evaluates Tesla and EV peers through a 5–10-year lens, prioritizing innovation over short-term metrics. This long-term perspective aligns with the transformative nature of the EV and autonomous driving industries. For instance, Tesla’s FSD (Full Self-Driving) beta program, though controversial, is a key differentiator that legacy automakers struggle to replicate. Wood’s willingness to look beyond the obvious—seeing Tesla as an AI company, not just an automaker—sets her apart.

In practice, investors can track ARK’s daily trades for real-time insights into Wood’s moves. Tools like Cathie’s Vision or ARK’s transparency initiative provide daily updates on fund holdings. Pair this with fundamental analysis of EV companies’ battery efficiency, charging infrastructure, and software capabilities. For example, Tesla’s 4680 battery cells promise 54% more range and 6x power, a game-changer for EV adoption. Finally, stay informed on global EV policies—subsidies in Europe, China’s dominance in battery production, and U.S. infrastructure investments—as these will shape the industry’s trajectory. Wood’s bullishness is a call to action, but it’s the underlying trends and data that justify her optimism.

Cathie Wood's Robinhood Move: Did ARK Invest Buy In?

You may want to see also

Explore related products

Biotech Bets: ARK’s investments in cutting-edge biotech and healthcare companies

Cathie Wood’s ARK Invest has become synonymous with bold, forward-thinking bets on disruptive innovation, and biotech is no exception. Within its portfolio, ARK’s investments in cutting-edge biotech and healthcare companies reflect a strategic focus on transformative technologies poised to redefine medicine. These "Biotech Bets" aren’t just about chasing the next blockbuster drug; they’re about backing companies that leverage genomics, gene editing, and AI to address previously untreatable diseases and personalize healthcare at an unprecedented scale.

Consider CRISPR gene editing, a technology ARK has heavily invested in through companies like Intellia Therapeutics and CRISPR Therapeutics. These firms are pioneering therapies that could cure genetic disorders at their source. For instance, Intellia’s NTLA-2001, a single-dose treatment for transthyretin amyloidosis, has shown promising results in early trials, potentially replacing lifelong management with a one-time cure. ARK’s conviction here isn’t just about the science—it’s about the economic shift from recurring treatments to curative solutions, a paradigm shift in healthcare economics.

Another area ARK is targeting is liquid biopsies, exemplified by investments in Guardant Health. This technology allows for early cancer detection through a simple blood test, identifying tumor DNA fragments before symptoms appear. For patients over 50, incorporating a liquid biopsy into annual checkups could be a game-changer, especially for cancers like pancreatic or ovarian, which are often diagnosed too late. ARK’s bet here is on the scalability of diagnostics, reducing healthcare costs by catching diseases early and improving survival rates.

ARK’s biotech strategy also extends to AI-driven drug discovery, with investments in companies like Recursion Pharmaceuticals. By using machine learning to analyze biological data, Recursion aims to accelerate drug development timelines from a decade to just a few years. This approach could slash R&D costs, making it feasible to target rare diseases that traditional pharma often ignores. For investors, this isn’t just a humanitarian win—it’s a financial opportunity in a market projected to grow exponentially as personalized medicine becomes the norm.

However, these bets aren’t without risk. Biotech is notoriously volatile, with clinical trial failures or regulatory setbacks capable of halving a stock overnight. ARK’s approach, though, is to diversify within the theme, spreading risk across multiple companies and technologies. For individual investors, this underscores the importance of patience and a long-term horizon. Biotech breakthroughs rarely happen overnight, but when they do, the payoff can be life-changing—both for patients and portfolios.

In summary, ARK’s "Biotech Bets" are a masterclass in identifying companies at the intersection of biology and technology, where innovation has the potential to disrupt entire industries. From gene editing to AI-driven drug discovery, these investments aren’t just about financial returns; they’re about backing the future of healthcare. For those willing to embrace the volatility, ARK’s portfolio offers a roadmap to the cutting edge of medicine—and the opportunity to invest in a healthier, more personalized future.

Is Buying Wood from Woodcraft a Cost-Effective Choice?

You may want to see also

Explore related products

Bitcoin and Crypto: Wood’s outlook on Bitcoin and blockchain technology investments

Cathie Wood, the founder and CEO of ARK Invest, is renowned for her forward-thinking approach to disruptive innovation. Her outlook on Bitcoin and blockchain technology is no exception, as she views these assets not just as speculative investments but as transformative forces reshaping global finance. Wood’s conviction in Bitcoin stems from its potential to serve as a hedge against inflation and a store of value, akin to digital gold. ARK Invest’s research suggests that if institutions allocate just a fraction of their portfolios to Bitcoin, its price could surge dramatically, with a long-term target of $1.48 million per coin. This bold prediction underscores her belief in Bitcoin’s scarcity and its role in a decentralized financial ecosystem.

Wood’s investment strategy extends beyond Bitcoin to the broader blockchain ecosystem. She identifies blockchain technology as a foundational layer for innovation, enabling applications like decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts. ARK Invest’s portfolios reflect this by including companies like Coinbase, which facilitates cryptocurrency trading, and Square (now Block), which integrates Bitcoin into its payment systems. By focusing on both the currency and the infrastructure, Wood positions her funds to capitalize on the entire crypto value chain.

One of Wood’s key insights is the interplay between Bitcoin and institutional adoption. She argues that as more corporations and governments embrace Bitcoin, its volatility will decrease, making it a more viable asset for traditional investors. For instance, companies like MicroStrategy and Tesla have already added Bitcoin to their balance sheets, signaling growing acceptance. Wood also highlights the energy narrative, countering critics by emphasizing Bitcoin’s role in incentivizing renewable energy adoption through mining operations. This perspective reframes Bitcoin not as an environmental hazard but as a catalyst for sustainable energy innovation.

Practical takeaways for investors include diversifying exposure to both Bitcoin and blockchain-related equities. Wood recommends a long-term horizon, as the technology is still in its early stages. For individual investors, she suggests starting with small allocations—perhaps 2-5% of a portfolio—to Bitcoin and ETFs like ARK’s innovation funds. Caution is advised, however, as the crypto market remains highly volatile and regulatory risks persist. Wood’s approach is not about timing the market but about recognizing the long-term potential of a technology that could redefine finance.

In conclusion, Cathie Wood’s outlook on Bitcoin and blockchain technology is rooted in a deep understanding of their disruptive potential. Her investment thesis combines macroeconomic trends, technological analysis, and a vision for the future of finance. By focusing on both the currency and the underlying infrastructure, Wood offers a comprehensive strategy for investors looking to participate in this emerging asset class. Her bold predictions and unwavering conviction serve as a guide for those willing to embrace the opportunities—and risks—of the crypto revolution.

Where to Buy Dried Wolmanized Wood: A Comprehensive Guide

You may want to see also

Frequently asked questions

Cathie Wood, through her ARK Invest funds, is actively buying innovative technology companies, particularly in areas like artificial intelligence, robotics, DNA sequencing, and energy storage. Recent purchases include Tesla (TSLA), Roku (ROKU), and UiPath (PATH).

Yes, Cathie Wood continues to buy Tesla (TSLA) through ARK Invest’s funds, despite market volatility. She remains bullish on Tesla’s long-term potential in electric vehicles, autonomous driving, and energy solutions.

Cathie Wood is focusing on disruptive healthcare companies, particularly in genomics and biotechnology. Recent buys include Teladoc Health (TDOC), Pacific Biosciences (PACB), and CRISPR Therapeutics (CRSP).

Yes, Cathie Wood remains a strong believer in Bitcoin and blockchain technology. ARK Invest funds, particularly the ARK Next Generation Internet ETF (ARKW), hold significant positions in Coinbase (COIN) and the Grayscale Bitcoin Trust (GBTC). She also invests in companies leveraging blockchain for innovation.